How To Manufacture Luck

Most of us can name one person who seems to be perpetually in the right room at the right time. They meet the future co-founder in a queue. They stumble into an opportunity just as it inflects. They get the warm intro the week they decide to switch roles. From the outside, it looks like fortune keeps choosing the same people.

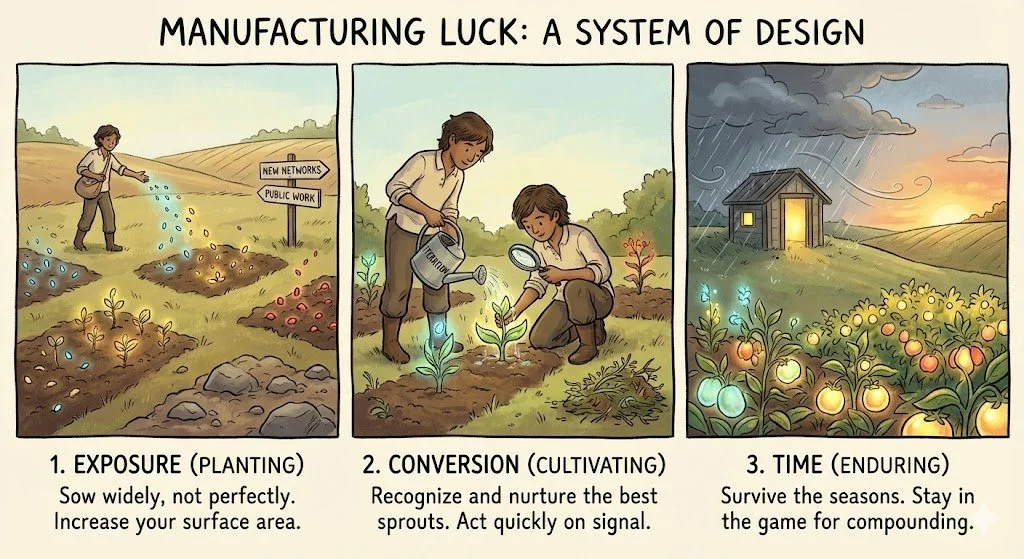

The more useful interpretation is colder: what we call “luck” is often the visible residue of an invisible system. People who look lucky tend to run higher exposure to opportunity, convert more of what they encounter, and stay in the game long enough for compounding to do its work.

That framing matters because the start of a year is when most people optimise the wrong variable. They chase certainty: better plans, cleaner roadmaps, more control. But in domains where outcomes are driven by variance, the highest-leverage skill is not prediction. It is designing your life and work to capture upside when it appears, while avoiding the kinds of failure modes that take you out of the game.

Luck as a system, not an event

A practical definition:

Luck = exposure × conversion × time

Exposure: how frequently you collide with interesting opportunities.

Conversion: how often you recognise and turn those collisions into outcomes.

Time: how long you can keep doing the first two without getting wiped out.

This is not motivational. It is just the mechanics of compounding under uncertainty. A single lucky break can happen to anyone. Consistent “luck” is usually a cumulative advantage.

Venture capital is built on the same decomposition. At the fund level, returns depend on (1) dealflow surface area (exposure), (2) selection and conviction (conversion), and (3) portfolio survival plus reserves (time). When people describe a fund as “fortunate” to back a breakout, they are usually pointing at a process that increased the probability of encountering the right company, recognising it, and having enough staying power to hold through the volatility.

The same logic applies to careers, entrepreneurship, and creative work.

1) Increase exposure: raise your collision rate

Opportunity is not evenly distributed. It concentrates around people who are more discoverable, more connected, and more active. “Be visible” sounds social. In practice, it is an information and access strategy.

A few reliable levers:

Do more shots, not more perfection: In uncertain environments, one big win can dwarf ten small misses. If you cannot reliably predict what will work, the rational move is to increase the number of attempts, while keeping the cost of each attempt low.

Work in public, in a way that compounds: A single update is marketing. A body of work is infrastructure. The goal is to make your interests and competence searchable and legible. Over time, this attracts inbound opportunities that do not exist for people doing equally good work in private.

Prioritise weak ties and new contexts: Strong ties reinforce what you already know. Weak ties expand your opportunity set. Similarly, staying inside the same routines creates diminishing returns. New rooms expose you to new distributions.

Exposure is not about being busy. It is about designing a higher-quality set of encounters.

2) Increase conversion: turn encounters into outcomes

Higher exposure creates more raw opportunity, but outcomes come from conversion. Two people can see the same opening and have different results because one recognises it faster, moves with less friction, and has the skills to execute.

Conversion is driven by:

Pattern recognition (domain depth): What looks like “lucky timing” is often simply seeing weak signals earlier. Expertise compresses time to insight.

Speed of iteration: Treat initiatives as experiments. Run them fast enough that feedback arrives while it is still useful. Most people lose luck because they over-commit early, then defend sunk costs.

Reversibility discipline: Make reversible decisions quickly. Save slow deliberation for decisions that are truly permanent. This preserves optionality and keeps you moving.

Strategic optimism: Not blind positivity, but a bias towards action in ambiguous situations. Many opportunities are missed not because they are invisible, but because anxiety narrows attention and makes people default to inaction.

Conversion is the difference between “I met someone interesting” and “that meeting changed my trajectory”.

3) Extend time: avoid ruin and keep slack

This is the unglamorous part of luck engineering. Compounding requires survival. The easiest way to lose future upside is to take one avoidable, tail-risk hit: financial, reputational, or health-related.

Time is protected by:

Avoiding total ruin: Do not take bets that can permanently end your ability to play. In investing language, do not optimise for high expected value if the distribution includes wipe-out.

Maintaining slack: A schedule at 100% cannot absorb serendipity. A budget at 100% forces you to say no to opportunities. Slack is not inefficiency; it is optionality.

Staying flexible: Rigid plans blind you to better options. Many “lucky breaks” are only valuable to someone willing to pivot.

In venture, we call this “staying alive” and “reserves”. In life, it is the same principle.

The meta-principle for 2026

In uncertain environments, the shape of your exposure matters more than your predictions.

If you structure your work so the downside is limited but the upside is unbounded, and you increase the surface area over which opportunity can find you, luck stops being an explanation and becomes an output.

What looks like good fortune to outsiders is often a simple combination:

more shots taken,

higher-quality rooms entered,

sharper recognition,

faster iteration,

and a refusal to get wiped out.

A practical playbook to start the year

If you want to operationalise this, keep it small and structural. The goal is not a new personality. It is a new system.

Exposure (collision rate)

Publish one substantive insight a week (not a “status update”, a real idea).

Have one conversation a week with someone outside your immediate domain.

Change one routine a month to force novel inputs (new community, format, or environment).

Conversion (turning contact into outcomes)

Run one low-cost experiment per month that could create asymmetric upside.

Make reversible decisions faster: act at 70% information, then course-correct.

Build one skill this quarter that increases your ability to capitalise on opportunity later.

Time (staying in the game)

Keep a buffer: time, money, energy. Protect it as a strategic asset.

Avoid reputation-damaging shortcuts. Trust compounds, and it compounds quietly.

Design your year so you can take the call, meet the person, say yes to the right thing.

None of this guarantees outcomes. That is the point. It increases your probability of encountering, recognising, and capturing upside in a world where variance does most of the selection.

Good luck, by design.

– Nankee Hari, Equanimity Investments