2025 Wrapped: Fewer Bets, Deeper Conviction, and a System That’s Finally Maturing

If 2021 was about speed and scale, 2025 felt very different on the ground. It was about signal over noise and substance over storytelling.

From where we sit, the Indian startup ecosystem did not slow down because capital vanished. It slowed because both founders and investors became far more intentional. This was the year where momentum was questioned, shortcuts were exposed, and the ecosystem quietly levelled up.

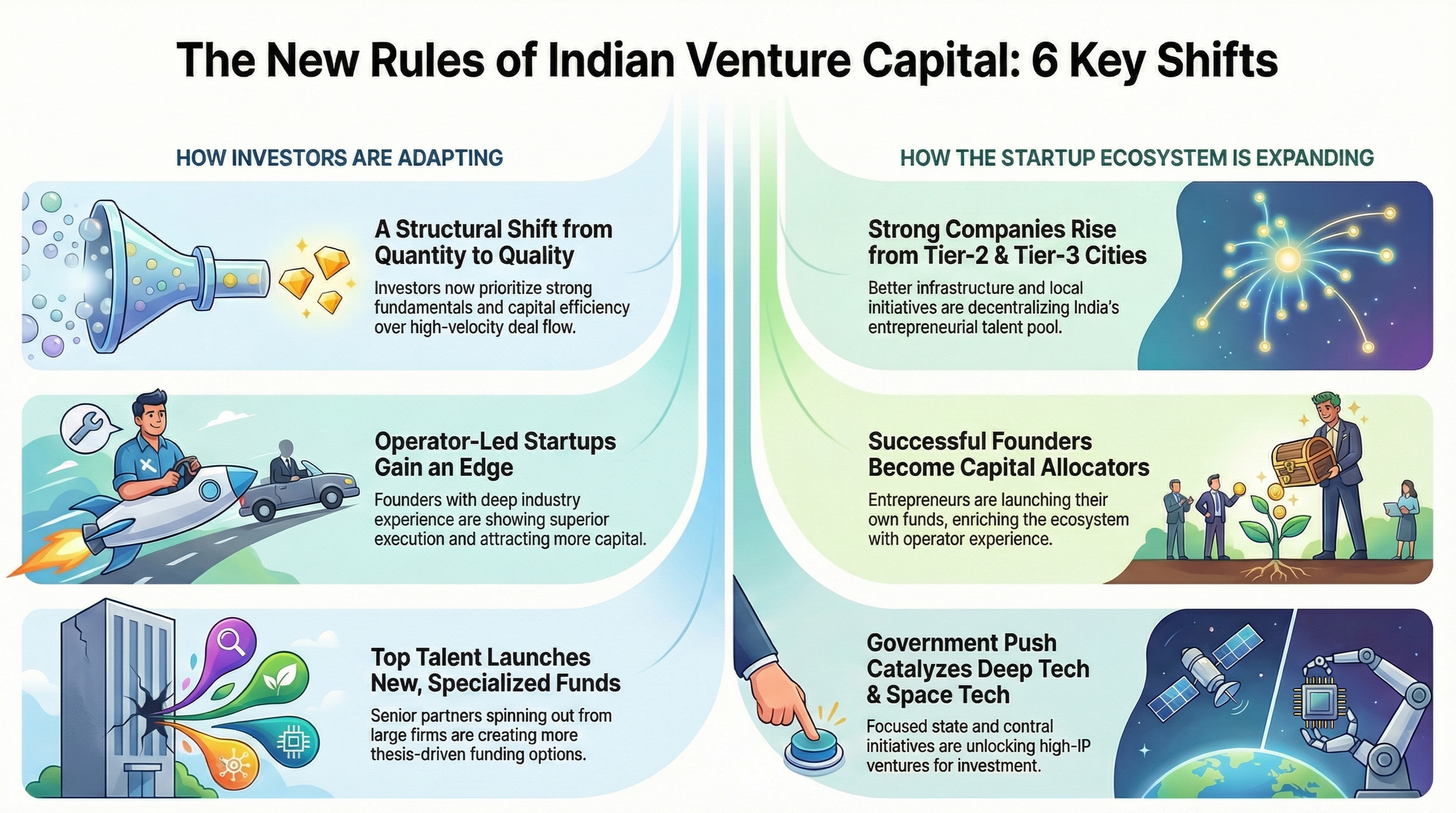

When we step back and look at the year in totality, a few clear patterns stand out.

Capital Didn’t Leave, It Concentrated

One of the most persistent misconceptions we encountered through the year was the idea of “capital scarcity”. In reality, capital was present throughout 2025. It was simply deployed into fewer, higher-conviction opportunities.

Investor sentiment was cautious, but not pessimistic. Valuations reset to levels that forced honesty, governance scrutiny deepened, and businesses without clear margins or retention struggled to progress. Rounds took longer to close, diligence went deeper, and bridge or inside-led extensions became the norm rather than the exception.

The data reflects what we felt anecdotally. While headline venture funding moderated, PE and VC investments in India still grew 20 percent year-on-year to USD 11.7 billion in Q3 FY25. Exit values surged 61 percent to USD 13.7 billion in the same period, reinforcing a simple truth we saw play out repeatedly: capital still rewards durability.

The signal from the market was consistent all year. Build something resilient, and capital will eventually find you.

Quality Over Quantity Became the Default Lens

Across funds, deal flow thinned. But it also improved.

Conversations shifted decisively from volume to fundamentals. We spent more time on underwriting unit economics, customer concentration, governance structures, and credible paths to profitability. This marked a clear break from the years where velocity often substituted for rigour.

Even as themes resurfaced – AI, climate, B2B efficiency – disciplined investors stayed anchored in first principles. Trends opened doors, but they no longer closed deals. High-burn consumer models cooled quickly, while capital-efficient businesses solving real operational pain continued to move forward.

A pattern repeated itself across the year: being trendy helped get attention, but being sound was what got funded.

India’s Capital Base Is Quietly Transforming

One of the most important shifts we observed this year did not come from founders or startups, but from the LP base.

Commitments to AIFs have grown sixteen-fold since 2017, reaching USD 152 billion in 2025. More significantly, domestic LPs now contribute over half of capital across Category I and II AIFs. In practice, this shift was visible in the types of conversations funds were having and the patience embedded in capital.

This feels structural rather than cyclical. India’s wealth base is expanding rapidly, with millionaire households nearly doubling over the last four years. Increasingly, that capital is finding its way into professionally managed private markets.

Layered on top of this, we saw successful founders setting up family offices, senior partners spinning out to launch focused funds, and new managers backed by both private and state-supported capital. Together, these developments point to a venture ecosystem that is becoming more domestically anchored and inherently more resilient.

Follow-Ons, Secondaries, and Harder Cap Table Conversations

2025 was not a year of flashy new cap tables. It was a year of working through existing ones.

Follow-on rounds dominated activity and often involved bringing new investors onto already complex cap tables. These processes were rarely frictionless. Negotiations around governance, equal rights, and long-term alignment took time, but in most cases resulted in more robust structures.

At the same time, secondaries became a meaningful liquidity path. New funds focused exclusively on secondary transactions entered the market with disciplined pricing. For early-vintage funds, this created an avenue to generate partial liquidity without forcing premature outcomes.

The exit mix reflected this maturity. Strategic exits dominated, but secondaries and open-market exits contributed meaningfully as well. This diversity is a hallmark of a functioning ecosystem, one where liquidity is not dependent on a single route.

Geography Is Expanding, Quietly but Meaningfully

Some of the most compelling companies we saw this year did not come from the usual pin codes.

There has been a steady rise in high-quality startups emerging from Tier 2 and Tier 3 cities, becoming home to nearly 51% of the total startups in India, supported by increasingly proactive state government initiatives. Karnataka, in particular, leaned into deep tech, space tech, and R&D-led innovation through targeted programmes and funding support.

While 48 percent of the deals we evaluate come from the traditional hubs of NCR, Mumbai, and Bengaluru, a majority of the opportunities we engaged with originated from other cities across India. This is not a token dispersion. Many of these companies showed strong fundamentals, capital efficiency, and founders with deep local market insight.

What we are seeing is not just geographic spread, but depth. Better infrastructure, distributed talent, and targeted state-level initiatives are enabling founders outside the usual pin codes to build companies that can compete on equal footing.

Operators Are Pulling Ahead

One of the clearest patterns we observed this year was the rise of operator-led entrepreneurship, and this showed up very clearly in our own portfolio construction.

The average founder age across Equanimity’s investments today is 38.5. This is not accidental. It reflects a growing share of founders who are building their second or third ventures, or stepping out after a decade or more of operating experience in the same industry.

These founders tend to move differently. Go-to-market decisions are sharper, early customer conversations are more grounded, and there is far less experimentation for experimentation’s sake. In a capital-disciplined environment, that maturity compounds quickly, reducing execution risk and shortening the path to meaningful scale.

This shift towards experience-led entrepreneurship was one of the strongest signals of ecosystem maturation we saw through the year.

Founders Listen Differently as They Scale

One subtle but recurring insight from the year was that the source of feedback matters as much as the feedback itself.

Founders often discounted repeated inputs from existing investors, not due to mistrust, but familiarity. The same insight, when echoed by an external banker, an incoming investor, or a market signal, carried significantly more weight.

This is a natural evolution. As companies scale and stakes rise, validation shifts from internal conviction to external corroboration. Founders who recognised and adapted to this dynamic navigated growth far more smoothly.

A Reset to Sanity

Taken together, 2025 did not feel like a slowdown. It felt like a reset.

Capital became more selective, not scarce. LP bases deepened and localised. Exits diversified beyond IPOs. Governance and profitability moved to the centre. Operators and disciplined founders pulled ahead.

From our perspective at Equanimity, this is precisely the environment where enduring companies get built. The convergence of stronger domestic capital pools, improving founder quality, active government participation, and a reopening exit environment positions India well. Not for a frothy cycle, but for a defining decade of venture creation.

And that, more than any headline number, is what leaves us genuinely optimistic about what lies ahead.