The Life of a Deal: From First Glance to Final Wire

Every deal begins quietly.

An email in the inbox. A pitch deck over coffee. A founder’s name dropped in a late-night WhatsApp. Sometimes it’s a company we’ve seen before–now with sharper traction or simply better timing. And just like that, a thread is pulled.

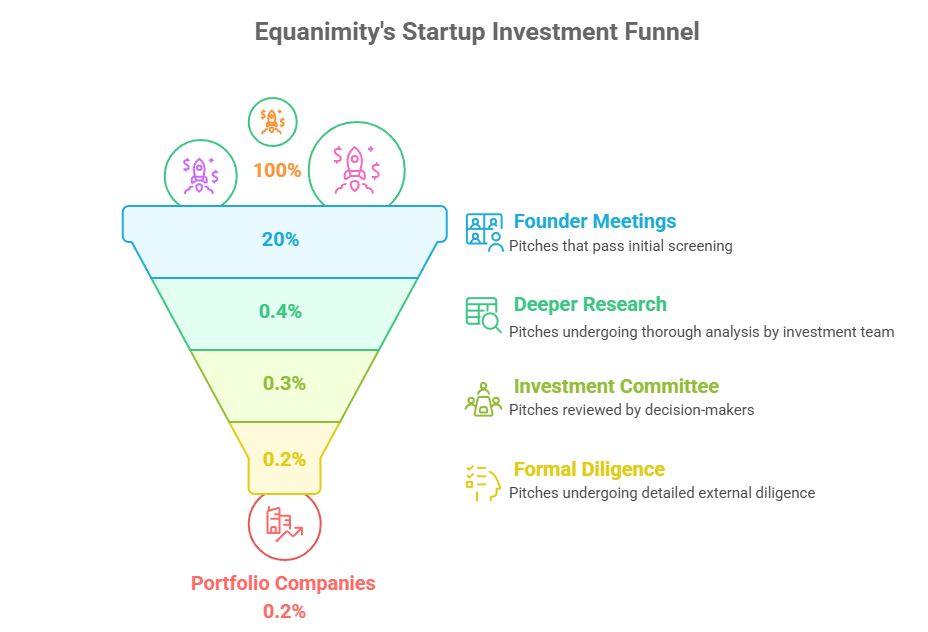

Roughly 20% of the opportunities we see move past initial screening into founder meetings. Just 0.4% make it into deeper research and internal diligence. 0.3% are brought to the Investment Committee. Around 0.2% make it to formal diligence. And finally, after weeks of questions, debate, and decision-making, only 0.2% of all deals become portfolio companies.

The Spark: Deal Receipt & Scoring

The first glance is quick. We look for crisp articulation of a problem, a counterintuitive market insight, and a founding team that feels born to solve it.

We score it – formally and otherwise. Some stories reveal themselves early, others require a bit more digging. If it holds our interest and shows fiscal promise, a conversation follows.

Serendipity Meets Thesis: First Call with the Founder

What starts as a 45-minute “let’s get to know you” often turns into a one/two-hour deep dive into market shifts, founder backstories, and product vision. This is where the narrative unfolds. We listen for clarity of thought, obsession with the problem, and the elusive but unmistakable why now.

Each one is met with curiosity. Not every pitch turns heads, but every now and then, something clicks. The market feels ripe. The approach feels fresh. The founder’s energy is infectious. The spark is real.

From there, the wheels start turning towards that narrow space between curiosity and belief.

The Slow Burn of Conviction: Venture Partner Review and Internal Sync

Good stories linger.

If we can’t stop thinking about a founder’s answer to “why now,” we dig deeper. We dissect metrics, talk to customers, understand unit economics, and pressure-test the roadmap. But numbers are only half the story. What we’re really assessing is founder-market fit, clarity of decision-making, and to understand how the pieces fit – and whether the conviction that sparked our interest still holds when the details come into focus. Because in the end, it’s the founders – their insight, resilience, and drive who shape how the story unfolds.

Sometimes we pull in domain experts. Sometimes we debate long after the call ends. We’re not looking for perfect answers – just the right patterns. Signals that hint at long-term potential, not just short-term traction. Every opportunity flows through a layered, democratic process that unfolds over weeks and often months. It’s built to filter noise, challenge assumptions, and ensure that when we do lean in – typically as a concentrated, high-conviction partner – we do so with clarity, alignment, and intent.

The Decision Room: Investment Committee Review

There’s a moment – quiet but significant – when a deal is laid out in full view. Numbers. Narratives. Nuance.

We don’t decide in a rush. We ask: Is this a founder we’d be proud to back? Is this a company that could return the fund? Are we underwriting ambition or hoping for luck? Because at Equanimity, luck isn’t a strategy. Conviction is earned through process, not chance. Every yes comes after deliberate, disciplined thinking – not a roll of the dice.

The best deals rarely sail through. They’re shaped by challenges. What survives scrutiny tends to deserve it.

The Offer: Term Sheet & Diligence

If everything lines up – market, founder, metrics, timing – we move forward. Terms are discussed. Structures are proposed. Everyone puts their cards on the table.

Some deals move fast, others need time. Good deals often need time. But once there’s alignment, we move quickly to get the paperwork sorted and the wheels in motion. From there, the process kicks into gear – third-party diligence, compliance checks – all the invisible machinery that turns conviction into commitment and we stay close through every step.

Of course, no deal is done until the money hits the bank – and between that and the final nod are pages of diligence, redlines, and a few legal curveballs. But once it closes, we celebrate quietly and get ready for the real work.

The Real Work Begins: Post Investment Involvement

This is the part most people never see.

Onboarding calls. Hiring decks. Reworking metrics dashboards. Navigating hard pivots and well-deserved wins. We become thought partners, connectors, sometimes therapists. For us, post-investment is where value gets built – not just tracked. We roll up our sleeves and get to work.

Every line in our portfolio update is the result of months of thinking, testing, and belief-building. We chase quality over noise. We make space for judgment, not just models. And we do it all because at the heart of our job is a simple idea: One good deal, done right, can create a successful entrepreneur and create many jobs. One good deal, done right, can change the course of a fund.