The World As We See It

Global

The last 24 months have been like no other time in recent history. Just as the world is opening up and we started seeing some semblance of normality, the Russia-Ukraine hotspot has us all in a bind. The topmost question on everyone's mind today is whether the war in Europe will cause a recession. At the least, we have to adjust our macro assumptions and even finance market assumptions to align with this era of sustained and heightened geopolitical risks. Inflation worries have not yet abated and commodity prices remain at elevated levels. Oil prices have moderated a bit though food prices remain at all-time highs and global supply chain issues have once again come to the fore. Monetary tightening has started in right earnest and the consequences of some early steps have not been a pretty sight. Historically, most Fed tightening cycles have led to recessions and the current state of the global economy doesn't appear to be in a shape to take that kind of a blow well. COVID-19 has reared its head again, this time in a place that supplies a lot of stuff to the rest of the world. How China manages to contain this situation without meaningful human impact and disruption remains to be seen.

Uncertainty reigns and we are all figuring out our way around this whole new paradigm brought about by the pandemic and now the ongoing war. Central bank balance sheets are bloated even as we march into this uncertain period. Global GDP projections are being moderated all across as the covid recovery spirit is being dampened by the ongoing Ukraine conflict, tight labour markets, intermittent supply chain disruptions, soaring energy prices, and consequent inflationary pressures. Global growth is projected to moderate to 4.4% in 2022 and further slow down to 3.8% in 2023, on the back of a buoyant 5.9% in 2021. Where economic growth and markets are headed is just about as clear as mud. The post-global financial crisis period has brought about unparalleled changes to the global economy. Rapid globalisation of the past decades is now being questioned and, in some cases, being reversed or at least slowed down. This will have an impact on all our portfolios and capital allocation decisions going forward and is something we have to keep on top of.

India

India has been pretty resilient even as the overall global macro backdrop is not as supportive. Corporate earnings growth for FY22 is expected to come in at 35%, a level not seen since FY04. The government has been making the right moves whether that be fiscal and monetary policies, egging on local manufacturing with schemes like the PLI (Production Linked Incentives) rollout, and supporting the bottom of the pyramid through well-targeted welfare schemes.

Corporate India's credit quality improved dramatically in the second half of FY22, making it the year of recovery. This improvement was due to growth in revenues from most sectors, which had been negatively hit by the pandemic coupled with the government's positive relief that tempered the damage even further.

India's two main sources of cash inflow: taxes, and borrowings, have both hit new records. The federal government's market borrowings have increased almost threefold over the last decade. In 2011, the government borrowed US$66.9 billion from the market to cover its deficit, compared to US$111 billion in the first half of this fiscal year. This will certainly have some impact on the overall cost of capital. GST being the primary source of indirect tax revenue for the government has reached an all-time high since its inception in 2017. The average monthly gross GST collections for FY22 stood at US$16.2 billion, up 30.5%. Anti-evasion measures and an increase in economic activity have contributed to this substantial increase. A direct fallout of the overall resilience is reflected in tax revenue collections which came in at US$355 billion grossing its highest tax/GDP ratio in this century.

Markets have done pretty well with the Nifty gaining 19% y-o-y despite a multitude of challenges highlighted in the global macro section. Domestic flows have been very supportive as reflected in the US$20 billion inflows in the second half itself neutralising the relentless FII outflows. In March 2022 alone, retail investors invested US$1.6 billion in mutual fund systematic investment plans indicating their stickiness and size.

RBI has started to prioritise inflation over growth as its focus area given the nature of inflation and its global relevance. Rates have started moving up with the 10-year government security yield breaching the 7% mark. Public debt to GDP has also grown to 60%, a matter of some concern but given the covid backdrop, this should start easing off soon. India continues to plug into the global economy and the level of integration is demonstrated by increasing exports and imports. Export in FY22 came in at US$418 billion while imports were US$610 billion, a 42% and 55% y-o-y growth respectively. Forex reserves continue to remain at over US$600 billion and the imports cover over 12 months, which is also the long-term average level.

Early Stage Ecosystem

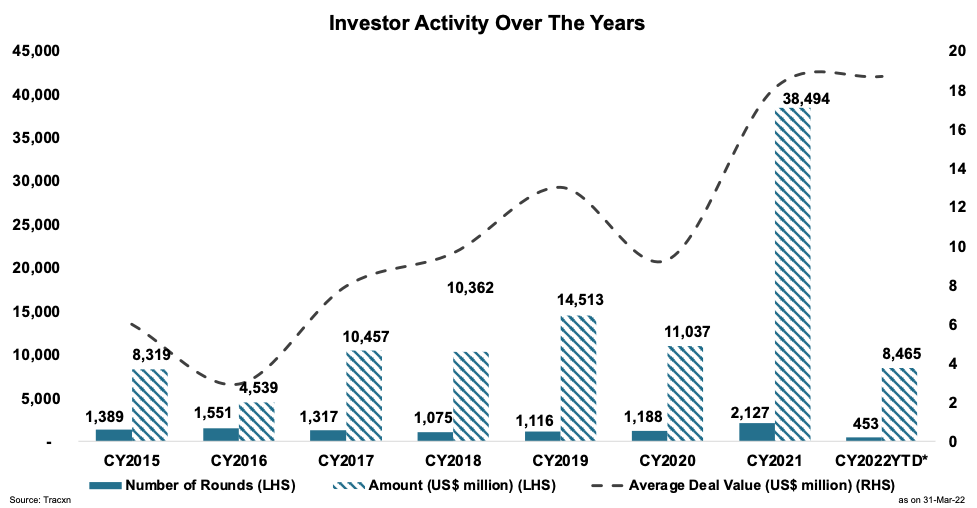

Carrying the momentum forward from 2021, the Indian Startup Ecosystem witnessed a robust first quarter of 2022. Even as overall numbers came in far better than expectations, the number of deals dropped by 42% (from 784 to 453), while the capital invested fell by 18.50% (from US$10.4 billion to US$8.5 billion), resulting in the average deal values rising by 41% (from US$13.2 million to US$18.7 million).

As the global technology sell-off continues, investments in the Indian Startup Ecosystem continue to buck the trend. In fact, the first quarter gave rise to 14 new Unicorns, namely Fractal Analytics, LEAD School, DarwinBox, DealShare, Polygon, ElasticRun, LivSpace, XpressBees, Uniphore Software Systems, Hasura, CredAvenue, Amagi Media Labs, Oxyzo Financial Services and Games 24x7. Investors continue to remain bullish on India as a whole, evidenced by the diversity of sectors attracting capital. This strengthens our belief that we are in the middle of a long-term trend rather than a blip or a bubble.

While capital seems to be a problem the ecosystem seems to be slowly solving, another issue that requires attention is innovation. As an ecosystem, innovation remains a problem that we have tried tackling but have come up short over the last few years. The US Chamber of Commerce Global Innovation Policy Center recently came out with the 2022 edition of its International Intellectual Property Index. India ranked 43 out of 55, slipping from 40 last year. Another measure, the Global Innovation Index 2021 ranked India 46 out of 132 countries, moving up two spots from last year. The Indian government has taken notice of the tepid pace of progress and in July 2021, the Parliamentary Standing Committee on Commerce released its ‘Review of the Intellectual Property Rights Regime in India’. The review comprised a comprehensive study of the strengths and weaknesses of India’s national IP environment and suggested measures to foster and encourage a conducive ecosystem to enable innovators to secure their IP rights in India. Moreover, the Delhi High Court also moved to establish a specialised Intellectual Property Division to help it manage its caseload. It seems that stakeholders know what needs to be done to level up India’s standing on the global innovation stage. These efforts have helped us remain bullish on India, its prospects to become a global innovation hub, and most importantly, its stupendous startup ecosystem.